Hi Everyone,

Wednesday, May 22, 2013

Update

We have been receiving a lot of great feedback regarding our blog. Please continue to leave comments and to

email us with any questions or blog post ideas.

Many of our posts are actually questions that were asked by readers, for

example, the posts “How to Create

an Accountant's Copy in QuickBooks” and

“QuickBooks =

Sales Receipts vs. Invoices” were both submitted by our

readers. Going forward, we will include

the reader’s first name and the city and state in which they live in our

post. If you have a question but would

rather remain anonymous, please make sure to include that in your email.

As always,

thanks for reading.

Sincerely,

Nicole Kerr

Wednesday, May 8, 2013

QuickBooks = Sales Receipts vs. Invoices

There are a few ways of recording daily sales in QuickBooks:

1.

Using invoices

2.

Using sales receipts

3.

Using the deposit window.

Many of the clients I work with understand what an invoice

is but are unsure of what a sales receipt is or the purpose it serves. In this article I will explain what the

differences are between the two and when to use them.

SALES RECEIPTS

Sales receipts are used to record daily sales. The benefit of using a sales receipt is that

the funds are immediately transferred into your bank account in QuickBooks (or undeposited

funds if you have that feature turned on).

The types of businesses that generally use sales receipts are: retail,

restaurants, gas stations, liquor stores, etc…

These types of business usually have dozens (if not hundreds) of transactions

per day. These businesses usually accept

cash, credit, and debit cards (some of them also accept checks).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

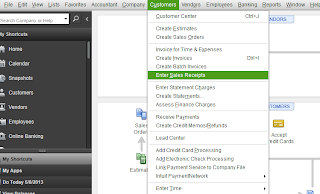

To enter a sales receipt in QuickBooks click on “Customers”

(top menu bar) and select “Enter Sales Receipts”.

INVOICES

Invoices are generally used by businesses that let their

customers pay via terms (i.e. net 10 or net 30). By using invoices, you can track the monies

still owed to you and you can track each customer’s total sales. You can also track marketing and referral

sources within those customers by adding custom fields.

Using invoices allows you to track sales by customer. You can run reports that show a breakdown of

what each customer purchased that month/quarter/year. It also allows you to receive partial

payments or record different forms of payment to be applied to a single

transaction. For example, one of my

clients is an auto mechanic. His

business uses sales receipts because he has a large number of transactions per

day and his customers pay at the time of the sale (on the rare occasion he will

let his customers make payments).

Although he uses sales receipts to record his daily sales he does need

to use invoices to record sales on occasion.

There are two situations where he uses an invoice instead of sales

receipt. The first is when a customer

will be making payments for the repair charges (which will need to be tracked). The total repair order could be for $2,000

but instead of paying the full $2,000 up front my client allows them to pay

using installments (i.e. ten $200 payments).

The second is when a customer pays a repair order with two different

payment methods (i.e. a check and a Visa card).

For example, if the repair order is for $2,500 the customer may pay $500

with a check and the remaining $2,000 using a credit card. In order to reconcile payments in QuickBooks

you have to make sure the payments are deposited (within QuickBooks)

correctly. Since cash/checks are

deposited separately from credit card charges it is better to enter the transactions

separately as well.

To enter an invoice click on “Customers” (top menu

bar) and select “Create Invoices”.

Summary

When it comes down to it the main difference between sales

receipts and invoices is this: When you

enter a sale using a sales receipt in QuickBooks the funds are immediately

moved into your bank account (or undeposited funds as mentioned above). When you enter a sale using an invoice in

QuickBooks the funds are immediately moved into Accounts Receivable. You then have to record and apply a payment

against that invoice to move the funds to your bank account (or undeposited

funds).

I hope this helps you understand the differences between

invoices and sales receipts. As always,

feel free to leave a comment or a question you may have. Thank you for reading.

Subscribe to:

Posts (Atom)