Monday, November 18, 2013

Reclassifying Transactions in QuickBooks

In the following video we show you how to reclassify transactions in QuickBooks Accountant.

Wednesday, November 6, 2013

How to Merge Names and Accounts in QuickBooks

In most QuickBooks files I see, there are usually a ton of duplicate names and accounts. In the following video, we show you how easy it is to merge these names and accounts, even if the names have jobs or "subnames" under them.

Saturday, October 5, 2013

The Importance of Updating QuickBooks

Let's start with defining the three QuickBooks categories: Product, Version, and Release. QuickBooks has many different desktop products: QuickBooks Pro, Premier, Enterprise, and Accountant. Each product has it's own version: 2011, 2012, 2013, and now 2014. QuickBooks updates it's software quite frequently. This is referred to as "a new release".

It is very important to update your QuickBooks file to the newest release. QuickBooks creates these releases to improve it's products. It is similar to updating your iPhone software of apps. Most people I know update their iPhone on a regular basis but do not update their QuickBooks software. Remember...tech companies create updates to improve their products. It's up to you if you want to utilize those improvements.

I was recently contacted by a local business who was having serious QuickBooks issues. After meeting with the client and trouble shooting the issue, I was sure that the file was corrupted in some way or another. The problem was, after verify and rebuilding the data, nothing was coming up with an error. The file acted like it was corrupted but wasn't showing that it was corrupted. I finally checked the release he was on and saw that it was R5. I searched online for the latest release with QuickBooks Pro 2011 and found it was R13! This guy hadn't updated his file in years! Sure enough, after updating his data file to the newest release the problems vanished. So remember, if you open your QuickBooks file and a window pops up informing you that there is a new release/update- download that update.

To check what release you are on, open your QuickBooks file and hit F2. This will bring up the "Product Information" window. At the top of this window you will see your product, version, and release. For example, for my business, I am currently using: QuickBooks Enterprise 2013 release 9.

If you are a user who rarely closes QuickBooks, you will never be prompted to update your file. In that case, you will need to manually download your updates. To check to see if you are on the latest release: Open QuickBooks, Click Help > Update QuickBooks.

The next item you want to be careful of is how old your QuickBooks version is. Intuit only services three years of QuickBooks products. This means, if you call QuickBooks because you are having issues like: your file won't open, you are getting error messages, your file keeps closing, etc... The service expiration date is usually around the end of March. If you are using QuickBooks 2011 you will want to upgrade before March 2014 because after March 2014 Intuit won't touch your QuickBooks file.

Now you may be asking, "Why should I upgrade? I have never had issues with my older version of QuickBooks." I have worked on several QuickBooks files that were so corrupted, they needed to be sent to Intiut's file fix site. This is where you upload your file and Intuit works on it, fixes it, and gives it back to you. In my experience, this can take anywhere from one to four weeks. This service is ONLY available for the most recent three years of QuickBooks products. If you are using QuickBooks 2010 and encounter an error, you are going to be in big trouble.

Many users don't realize that their file is corrupted until it's too late. They come into work one morning and try to open QuickBooks except QuickBooks won't open. It doesn't matter if you have backups of your file. You have no idea when the corruption started. Your only option at that point is to buy the newest version of QuickBooks and try and upgrade an old backup copy (which may not even work).

So remember, update your QuickBooks regularly and upgrade your software to a newer version at least once every three years.

Wednesday, May 22, 2013

Update

Hi Everyone,

We have been receiving a lot of great feedback regarding our blog. Please continue to leave comments and to

email us with any questions or blog post ideas.

Many of our posts are actually questions that were asked by readers, for

example, the posts “How to Create

an Accountant's Copy in QuickBooks” and

“QuickBooks =

Sales Receipts vs. Invoices” were both submitted by our

readers. Going forward, we will include

the reader’s first name and the city and state in which they live in our

post. If you have a question but would

rather remain anonymous, please make sure to include that in your email.

As always,

thanks for reading.

Sincerely,

Nicole Kerr

Wednesday, May 8, 2013

QuickBooks = Sales Receipts vs. Invoices

There are a few ways of recording daily sales in QuickBooks:

1.

Using invoices

2.

Using sales receipts

3.

Using the deposit window.

Many of the clients I work with understand what an invoice

is but are unsure of what a sales receipt is or the purpose it serves. In this article I will explain what the

differences are between the two and when to use them.

SALES RECEIPTS

Sales receipts are used to record daily sales. The benefit of using a sales receipt is that

the funds are immediately transferred into your bank account in QuickBooks (or undeposited

funds if you have that feature turned on).

The types of businesses that generally use sales receipts are: retail,

restaurants, gas stations, liquor stores, etc…

These types of business usually have dozens (if not hundreds) of transactions

per day. These businesses usually accept

cash, credit, and debit cards (some of them also accept checks).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

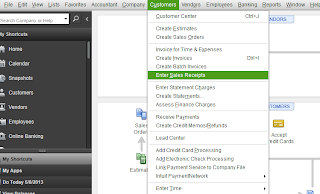

To enter a sales receipt in QuickBooks click on “Customers”

(top menu bar) and select “Enter Sales Receipts”.

INVOICES

Invoices are generally used by businesses that let their

customers pay via terms (i.e. net 10 or net 30). By using invoices, you can track the monies

still owed to you and you can track each customer’s total sales. You can also track marketing and referral

sources within those customers by adding custom fields.

Using invoices allows you to track sales by customer. You can run reports that show a breakdown of

what each customer purchased that month/quarter/year. It also allows you to receive partial

payments or record different forms of payment to be applied to a single

transaction. For example, one of my

clients is an auto mechanic. His

business uses sales receipts because he has a large number of transactions per

day and his customers pay at the time of the sale (on the rare occasion he will

let his customers make payments).

Although he uses sales receipts to record his daily sales he does need

to use invoices to record sales on occasion.

There are two situations where he uses an invoice instead of sales

receipt. The first is when a customer

will be making payments for the repair charges (which will need to be tracked). The total repair order could be for $2,000

but instead of paying the full $2,000 up front my client allows them to pay

using installments (i.e. ten $200 payments).

The second is when a customer pays a repair order with two different

payment methods (i.e. a check and a Visa card).

For example, if the repair order is for $2,500 the customer may pay $500

with a check and the remaining $2,000 using a credit card. In order to reconcile payments in QuickBooks

you have to make sure the payments are deposited (within QuickBooks)

correctly. Since cash/checks are

deposited separately from credit card charges it is better to enter the transactions

separately as well.

To enter an invoice click on “Customers” (top menu

bar) and select “Create Invoices”.

Summary

When it comes down to it the main difference between sales

receipts and invoices is this: When you

enter a sale using a sales receipt in QuickBooks the funds are immediately

moved into your bank account (or undeposited funds as mentioned above). When you enter a sale using an invoice in

QuickBooks the funds are immediately moved into Accounts Receivable. You then have to record and apply a payment

against that invoice to move the funds to your bank account (or undeposited

funds).

I hope this helps you understand the differences between

invoices and sales receipts. As always,

feel free to leave a comment or a question you may have. Thank you for reading.

Wednesday, April 3, 2013

SAN RAFAEL: MEASURES A & B

ATTENTION SAN RAFAEL RESIDENTS,

Our local schools

need our help. If you live in San

Rafael you should be receiving a local ballot in the mail soon. This is a mail-in ballot which must be

returned by May 8, 2013. This ballot

contains two measures that we desperately need to pass in order to protect our

local schools- measures A and B.

Our local schools

need our help. If you live in San

Rafael you should be receiving a local ballot in the mail soon. This is a mail-in ballot which must be

returned by May 8, 2013. This ballot

contains two measures that we desperately need to pass in order to protect our

local schools- measures A and B.

The state has drastically cut school funding over the years

(over $17,000,000 since 2009). Because

of this, our state has relied on local funding.

Without this local funding our schools would be forced to perform drastic

spending cuts. This local funding is

about to expire and we need your help to keep it going.

Please help our children receive the best education they can

by voting yes on measures A and B. We need this money to fund critical programs

for our local schools. A yes vote renews

the expiring parcel taxes. Remember, this

is not an increase in tax… it’s just renewing the taxes that were already

in place.

JOIN ME BY VOTING YES ON MEASURES A AND B.  Our local schools

need our help. If you live in San

Rafael you should be receiving a local ballot in the mail soon. This is a mail-in ballot which must be

returned by May 8, 2013. This ballot

contains two measures that we desperately need to pass in order to protect our

local schools- measures A and B.

Our local schools

need our help. If you live in San

Rafael you should be receiving a local ballot in the mail soon. This is a mail-in ballot which must be

returned by May 8, 2013. This ballot

contains two measures that we desperately need to pass in order to protect our

local schools- measures A and B. Thank you everyone for your support.

To learn more about these measures please visit www.Yes4SanRafael.org.

Sincerely,

Nicole Kerr

Saturday, January 26, 2013

How to Create an Accountant's Copy in QuickBooks

Instead of compiling and exporting

a long list of reports to send to your CPA why not send them an Accountant's

Copy from QuickBooks instead. Creating an

Accountant’s Copy is very easy and it just takes a few short steps. Before we get into those, let's first explain what an "Accountant's Copy" is.

If you are using QuickBooks you are probably familiar with backing it up. For us in the accounting world, that is one way of getting a company file from a client. It is best to backup your company file on a USB drive and then give it to your accountant. The problem with this is that you CANNOT work in your company file while your accountant has it. Backup copies do not merge with one another. They rewrite all of your existing data. So if you gave your accountant a copy of your company file (via a backup on a USB drive) and then you continued to work in your file... ALL of your changes would be erased once you uploaded the accountant's backup back on to your computer.

The other way accountant's work on client's QuickBooks files is to remote on to the client's computer. (There is some work that has to be done before this happens). When your accountant remotes on to your computer they literally take your computer over. Intuit has a remote service they offer for a fee that lets the accountant only access QuickBooks but they are still on your computer (just remotely). When they are working on your computer you cannot use it.

As you can see, there are issues with both the backup and remote access options. Giving you CPA a backup doesn't work because you wouldn't be able to use your QuickBooks file for several months. The remote access option doesn't work either because you'd never know when your CPA was going to need to log on to your computer. This is where the Accountant's Copy comes in.

An Accountant's Copy is just like a backup (but with a couple differences). The first, and most important difference) is that the two files merge back together. This means that you can continue to work in your company file while your CPA has it. The second difference is that an Accountant's Copy is not backed up on a USB. It is uploaded to Intuit's secure website. You can do this by following a few easy steps below. Your CPA is notified (via email) that you have sent them an Accountant's Copy. There is a link in that email to download the file.

The Accountant's Copy is not perfect but it is the best way of sending your CPA your financials at the end of the year. Keep in mind, once you send an Accountant's Copy to someone you cannot edit anything in that period (for example, if you sent your CPA an Accountant's Copy of last year you would not be able to edit anything in that period). This will also be explained below.

Now...let's get started.

If you are using QuickBooks you are probably familiar with backing it up. For us in the accounting world, that is one way of getting a company file from a client. It is best to backup your company file on a USB drive and then give it to your accountant. The problem with this is that you CANNOT work in your company file while your accountant has it. Backup copies do not merge with one another. They rewrite all of your existing data. So if you gave your accountant a copy of your company file (via a backup on a USB drive) and then you continued to work in your file... ALL of your changes would be erased once you uploaded the accountant's backup back on to your computer.

The other way accountant's work on client's QuickBooks files is to remote on to the client's computer. (There is some work that has to be done before this happens). When your accountant remotes on to your computer they literally take your computer over. Intuit has a remote service they offer for a fee that lets the accountant only access QuickBooks but they are still on your computer (just remotely). When they are working on your computer you cannot use it.

As you can see, there are issues with both the backup and remote access options. Giving you CPA a backup doesn't work because you wouldn't be able to use your QuickBooks file for several months. The remote access option doesn't work either because you'd never know when your CPA was going to need to log on to your computer. This is where the Accountant's Copy comes in.

An Accountant's Copy is just like a backup (but with a couple differences). The first, and most important difference) is that the two files merge back together. This means that you can continue to work in your company file while your CPA has it. The second difference is that an Accountant's Copy is not backed up on a USB. It is uploaded to Intuit's secure website. You can do this by following a few easy steps below. Your CPA is notified (via email) that you have sent them an Accountant's Copy. There is a link in that email to download the file.

The Accountant's Copy is not perfect but it is the best way of sending your CPA your financials at the end of the year. Keep in mind, once you send an Accountant's Copy to someone you cannot edit anything in that period (for example, if you sent your CPA an Accountant's Copy of last year you would not be able to edit anything in that period). This will also be explained below.

Now...let's get started.

In your QuickBooks company file...

1. Go to File > Accountant’s Copy > Send

to Accountant

2. Click “Create Accountant’s Copy”

3. Click “Next”

4. Under “Dividing Date” select “Custom” and

then enter 12/31/12.

5. Click “Next”

6. Enter your CPA’s email address

7. Reenter your CPA’s email address

8. Enter your name

9. Enter your email address

10. Click “Next”

11. Create a strong password (make sure it’s at

least 7 characters long and includes at least 1 digit and at least 1 capitol

letter) – MAKE SURE YOU WRITE THIS PASSWORD DOWN

12. Retype password

13. If you want to include a note for your CPA

write it in the box below. DO NOT WRITE

THE PASSWORD HERE. I always recommend

sending the Accountant’s Copy first and then emailing (or calling) your CPA with

the password.

Unfortunately there are some restrictions in your QuickBooks file once that copy is sent. For example, you cannot edit or delete an account in the Chart of Accounts (even if that account has never been used). You also cannot edit or delete any information in the prior year. If you try and edit or delete something that would affect the Accountant's Copy you will receive this error:

Don't freak out. There is a way of removing the restrictions that are applied once an Accountant's Copy is sent. Please keep in mind that if you remove the restrictions your CPA will not be able to import their adjusting entries into your company file. Make sure you check with your CPA before proceeding.

To remove the Accountant's Copy restrictions go to File > Accountant's Copy > Remove Restrictions. This box will then pop up:

Click the box (Yes, I want to remove the Accountant's Copy restrictions) and then click "OK".

Now you may be wondering... "What happens if my CPA doesn't have compatible software?" or "What if my CPA prefers actual financial statements?".

Most CPAs I know prefer to be sent an Accountant's Copy of the

QuickBooks file in question. Very few

prefer to just be sent financial statements.

However, if you have an old version of QuickBooks you may have to send your CPA actual financial statements. Your CPA may have a version of QuickBooks that is not compatible with your file (they have to have the same year or the year after that). For example, if you have QuickBooks 2009 your

CPA would have to have either QuickBooks 2009 or 2010 to make any adjusting entries in your company file.

If this happens, or if your CPA prefers that you send them your financials

instead of an Accountant’s Copy here is most likely what they will need:

Profit & Loss (Reports > Company &

Financial > Profit & Loss Standard)

Balance Sheet (Reports > Company &

Financial > Balance Sheet Standard)

Trial Balance (Reports > Accountant &

Taxes > Trial Balance)

General Ledger (Reports > Accountant &

Taxes > General Ledger)

Your CPA may request additional reports but in my

experience, these four are the most crucial.

Good luck everyone. As always, if you have any questions please leave a comment below or email us at info@kerrbookkeeping.com.

Wednesday, January 23, 2013

1099s

For those of you who don’t know… 1099s are due January 31st! Out of all of the businesses I know, only one

or two were ready to file 1099s. This is

actually very common. This is caused by

businesses NOT requiring vendors to fill out W-9s. Here is what I always tell my clients: “When

in doubt have vendors fill out a W-9. It’s

better having one on file and not needing it, than not having one and

scrambling to get it at the end of the year.”

So let’s get back to the basics…

Q: What is a 1099?

A: 1099s are similar

to W-2s. W-2s are used to report wages to

employees. 1099s are used to report

wages paid to independent contractors.

There are several different kinds of 1099s. The three most common are 1099-MISC (used to

report miscellaneous wages), 1099-DIV (used to report dividends paid), and 1099-INT

(used to report interest income). Most

of the small businesses I work with only file 1099-MISCs.

Q: The 1099-INT and

1099-DIV are pretty self explanatory but WHO DO I NEED TO FILE 1099-MISCS FOR?

A: You need to file a

1099-MISC for anyone you paid over $600 (per calendar year) for work performed (or

other work related services). You also

need to file a 1099-MISC for your landlord (if your landlord in not a

corporation). My client’s file 1099s for

my company using my company’s EIN (tax payer ID). Other types of individuals or businesses you

may need to file 1099s for are: consultants, IT professionals, web developers, lawyers,

landlords, contractors (construction), doctors, etc… Most 1099s are filed for businesses that

operate either as a sole proprietor or partnership. You do not need to file 1099s to corporations

unless the payments you sent

to them were for legal, medical, or fishing related activities.

Q: Okay, I understand

what a 1099 is, but what is a 1096?

A: A 1096 is a

summary of all the 1099s you filed. For

example, let’s say you file three 1099s.

One was for $800, one was for $2,200, and the last was for $1,300- Your

1096 would total $4,300. I like to think

of 1099s as the detailed forms and the 1096 as the summary form.

Q: How to I file

1099s?

A: There are two ways

you can file your 1099s. You can mail

them or you can e-file them. If you only

need to file a few 1099s I recommend e-filing them. If you need to file a lot of 1099s (and you

use accounting software like QuickBooks) I recommend mailing them.

Before mailing 1099s or your 1096 you have to go to buy the

actual forms. Beware…the 1099 forms are usually

very expensive. For example, Intuit

charges $69.99 for only (10-ten) 1099 forms!!

If you are using QuickBooks all you have to do is use the 1099 Wizard

and follow the steps. Once the process

if complete you just print your 1099s and your 1096 (using the 1099 and 1096

forms you purchased) and mail them out. Remember

to make two copies of each 1099 - one to send to the individual who you are

filing one for; the other you mail to the IRS.

E-filing is also pretty simple but has a few additional

steps. First, you need to find out

exactly who you need to file 1099s for.

This can also be done using

the 1099 Wizard in QuickBooks. The

information you will need in order to e-file a 1099 is: payee’s name, address, SSN/EIN,

and the amount paid to the payee during the calendar year in question. The payee’s email and phone number are not

required but I recommend using them if you have them. Once you have compiled this information you

are ready to e-file. There are many

websites that offer e-file for 1099s.

The one that I use is www.efileforbusiness.com.

Q: What else do I

need to know about 1099s?

A: The most important

thing to remember is that 1099s are due Jan. 31st (so are W-2s if

you haven’t mailed those out yet).

Secondly, if you are unsure about who to file a 1099 for or how to file one,

I recommend hiring a bookkeeper or CPA.

It’s better to be safe than sorry.

The last thing to remember is this…

You DO need to file a 1099 for your landlord if: 1.You paid your

landlord more than $600 in the calendar year and, 2. If your landlord is a sole

proprietor or partnership. The most

common misconception I hear regarding 1099s is that you do not need to file a 1099 for rent.

This is NOT true. There is a

special box on form 1099-MISC specifically for rent.

I hope this helps you understand what 1099s are about and

how to file them. If you have any more

questions please feel free to leave a comment.

Hello Everyone

Hi Everyone,

Thank you for checking out our blog. I just wanted to apologize for the lack of new posts recently. With tax time coming up we are extremely busy- it’s hard for me to set time aside to write up an interesting and informative posts (I am an accountant not a writer). J

This week I started thinking about taxes and about how stressed out everyone is around this time of year.

Here at Kerr Bookkeeping, we want to help individuals and businesses get prepared for the approaching tax deadlines. We also want to help ease some of that stress. Because of that, I finally sat down this week and started writing out a couple new posts. I have only completed one of them and will be posting up here shortly. In the meantime, please feel free to email us or leave a comment with any questions you may have. Or, if you have a topic you would like us to write about let us know. Our email is info@kerrbookkeeping.com.

As always, thanks for your support. I hope everyone had a nice holiday.

Sincerely,

Nicole Kerr- Owner

Subscribe to:

Posts (Atom)