There are a few ways of recording daily sales in QuickBooks:

1.

Using invoices

2.

Using sales receipts

3.

Using the deposit window.

Many of the clients I work with understand what an invoice

is but are unsure of what a sales receipt is or the purpose it serves. In this article I will explain what the

differences are between the two and when to use them.

SALES RECEIPTS

Sales receipts are used to record daily sales. The benefit of using a sales receipt is that

the funds are immediately transferred into your bank account in QuickBooks (or undeposited

funds if you have that feature turned on).

The types of businesses that generally use sales receipts are: retail,

restaurants, gas stations, liquor stores, etc…

These types of business usually have dozens (if not hundreds) of transactions

per day. These businesses usually accept

cash, credit, and debit cards (some of them also accept checks).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

When using sales receipts you still have to assign the

transactions to a customer account. Most

commonly used is one customer account named “Daily Sales”. You can also create a customer for each type

of bank deposit (i.e. 1-Cash (cash and checks), 2-Credit (Visa, MasterCard, and

Discover), and 3-Amex (American Express).

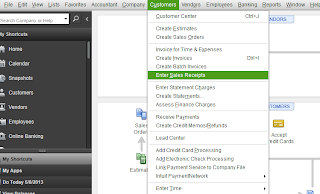

To enter a sales receipt in QuickBooks click on “Customers”

(top menu bar) and select “Enter Sales Receipts”.

INVOICES

Invoices are generally used by businesses that let their

customers pay via terms (i.e. net 10 or net 30). By using invoices, you can track the monies

still owed to you and you can track each customer’s total sales. You can also track marketing and referral

sources within those customers by adding custom fields.

Using invoices allows you to track sales by customer. You can run reports that show a breakdown of

what each customer purchased that month/quarter/year. It also allows you to receive partial

payments or record different forms of payment to be applied to a single

transaction. For example, one of my

clients is an auto mechanic. His

business uses sales receipts because he has a large number of transactions per

day and his customers pay at the time of the sale (on the rare occasion he will

let his customers make payments).

Although he uses sales receipts to record his daily sales he does need

to use invoices to record sales on occasion.

There are two situations where he uses an invoice instead of sales

receipt. The first is when a customer

will be making payments for the repair charges (which will need to be tracked). The total repair order could be for $2,000

but instead of paying the full $2,000 up front my client allows them to pay

using installments (i.e. ten $200 payments).

The second is when a customer pays a repair order with two different

payment methods (i.e. a check and a Visa card).

For example, if the repair order is for $2,500 the customer may pay $500

with a check and the remaining $2,000 using a credit card. In order to reconcile payments in QuickBooks

you have to make sure the payments are deposited (within QuickBooks)

correctly. Since cash/checks are

deposited separately from credit card charges it is better to enter the transactions

separately as well.

To enter an invoice click on “Customers” (top menu

bar) and select “Create Invoices”.

Summary

When it comes down to it the main difference between sales

receipts and invoices is this: When you

enter a sale using a sales receipt in QuickBooks the funds are immediately

moved into your bank account (or undeposited funds as mentioned above). When you enter a sale using an invoice in

QuickBooks the funds are immediately moved into Accounts Receivable. You then have to record and apply a payment

against that invoice to move the funds to your bank account (or undeposited

funds).

I hope this helps you understand the differences between

invoices and sales receipts. As always,

feel free to leave a comment or a question you may have. Thank you for reading.

Hi, nice post. This is an interesting and very informative topic. Thanks for sharing your ideas. Good blogs style too, can't wait to read another one like this. Cheers!

ReplyDeleteBookkeeping Services Framingham MA

$$$ GENUINE LOAN WITH LOW INTEREST RATE APPLY $$$

DeleteDo you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: shadiraaliuloancompany1@gmail.com

Phone No: +919873186890.

I wanted to thank you for this excellent read!! I definitely loved every little bit of it. I have you bookmarked your site to check out the latest stuff you post.Bookkeeping Houston

ReplyDeleteThank you for your post! It helped clear my doubts as I'm setting Quickbooks up for my wife's business as a Zumba instructor. I guess it makes sense to use Sales Receipts as otherwise she'd have to create 15-20 invoices every time she conducts a class! Of course she loses visibility of how much each customer has spent in total.

ReplyDeleteThank you,

Q

Just a note... you do NOT have to enter a customer when using a sales receipt. Good post.

ReplyDeleteGreat post! Very informative and helped me better understand the difference between sales receipts and invoices. Thanks for sharing.

ReplyDeleteBookkeeper Carlsbad

Here is a link that I think you will find interesting. Thanks for this wonderful post and hoping to post more of this.

ReplyDeletewww.absolutebkping.com

I want Upgrade to quickbooks online. Do you have any reference?

ReplyDeleteGreat Job with the post. Well written with just the right amount of information. If anyone is facing such issues with their software they can get responsive support for QuickBooks by clicking on the link.

ReplyDeleteI will prefer this blog because it has much more informative stuff. www.islandtax.ca

ReplyDeleteYou’ve made some good points there. It’s a good idea! Please visit http://goo.gl/dnHZjp

ReplyDeleteThis blog is truly extraordinary in all aspects.

ReplyDeleteBOOKKEEPING

I think I will need to try harder to accomplish my dream. I think it is not easy

ReplyDeleteBOOKKEEPING

$$$ GENUINE LOAN WITH LOW INTEREST RATE APPLY $$$

ReplyDeleteDo you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: shadiraaliuloancompany1@gmail.com

Phone No: +919873186890.

que es un contador BCD y un contador binario ?

ReplyDeletecpa accounting

QuickBooks support and training includes all sections of QuickBooks like how to print and send 1099's, customizing invoices, tracking sales and every minor to major features. Call QuickBooks support 1800-986-6730 to know more about QuickBooks features and specifications. http://quickbookscustomersupportnumber.com

ReplyDeletevirtual accountant is the best way to opt for an assistant without any issues. The virtual accounting services helps in keeping a track of the accounts. Visit our website to know more about us. marhabareception.co

ReplyDelete

ReplyDeleteMD Bookkeeping Doctor is the best accounting & bookkeeping services in NY. Visit us to know more about Online bookkeeping and accounting services.

It is always better to take the help of certified professionals for resolving issues pertaining to software function as they hold a good command on the software integration and know well how to correct it. There is no shortage of QuickBooks enterprise support USA. You must contact with QuickBooks desktop technical support phone number and solve your problem.

ReplyDeleteNothing can be best idea to solve the issue of QuicikBooks customers through this article, well explained I liked this post. But if you need any help contact with our toll free QuickBooks Pro Technical Support Phone Number 1-888-412-7852.

ReplyDeleteHiring BalanceWiseBookkeeping.com, an affordable bookkeeping services for small businesses.

ReplyDeleteOur team at QuickBooks Pro Support 1(800)674-9538 provide you immediate support for QuickBooks related issues. You can get in touch with us anytime or from anywhere.

ReplyDeleteGot stuck in QuickBooks errors? Not to worry now as we are here to solve all your queries. We at our Quickbooks Desktop Support Phone Number 1-800-986-4607 will assist you to get out of trouble.Avail the benefits of our services and run your business smoothly. Stay connected with us for more information.

ReplyDeleteNice & Informative Blog !

ReplyDeleteFor managing accounting tasks, you should use QuickBooks accounting software.In case you have faced any technical issues in QuickBooks, call us at QuickBooks Support Number 1-855-652-7978.

Thanks for sharing a great information with full of knowledge. Our Team resolves any glitches occurring while utilizing QuickBooks accounting software. Looking for QuickBooks instant support Service? Call us at our QuickBooks support phone number USA +1-(860) 499-4393, and get instant solutions to all your queries on a single call. QuickBooks Customer support phone number

ReplyDeleteThis is an amazing blog I loved reading it. Thanks for sharing it here.

ReplyDeleteIf you are facing issues with QuickBooks you can connect with QuickBooks Error Support Number and get solution for the errors occuring on your software.

Reach QuickBooks Error Support Number here : +1(860) 499-4393

Or Visit: https://askofficial.com/quickbooks-error-support

ReplyDeleteWell done! Great article...Keep sharing it with us...

sage 50 crashing after windows 10 update

sage 50 output error when restoring backup to an existing company

download quickbooks 2018

quickbooks 2019 iif import error

quickbooks internal server error 500

ReplyDeleteWell done! Great article...Keep sharing it with us...

how do i view sent emails for invoices in quickbooks

how to fix quickbooks error 10060

ReplyDeleteGreat Post!!Keep sharing it..

how do i view sent emails for invoices in quickbooks

how do you delete a recurring journal entry in quickbooks

add a new detail type category to the chart of accounts

ReplyDeleteWell done! Great article...Keep sharing it with us...

how to integrate quickbooks with smart vault

quickbooks amazon integration

Nice Blog !!Keep sharing it..

ReplyDeleteresolve database error 49153 sage accpac

fix sage error 1607

resolve all your QuickBooks errors with tools like QuickBooks File Doctor and QuickBooks Tool Hub. Just visit our page and get started.

ReplyDeleteMind-blowing blog....Keep sharing it with us...

ReplyDeletehow do you record a loan payment for fixed asset in quickbooks

quickbooks refresher tool

Quickbooks file doctor is an understood illustrative device developed especially to deal with the bugs that trigger association record pollution (can't open association reports), network hiccups, and hampers the smooth working of QuickBooks accounting programming. Having said that, the customers don't have to stand up to the unsettling influences while managing their assets and won't startle of accounting errors. Also, running the QBFD mechanical assembly can in like manner help you when you see some nastiest QuickBooks errors, for instance, error code - 6000, QB error 6150, error code 82, or QuickBooks error code H202 , H101, etc

ReplyDeleteI love your article so much and I appreciate your thought and views. This is really great work. Thank you for sharing such a

ReplyDeleteuseful information here on the blog.

QuickBooks Error OLSU-1024

QuickBooks Error 1625

QuickBooks Error 6000 77

QuickBooks Export to Excel not Working

QuickBooks Error 1904

download the old quickbooks to quickbooks latest version 2022

ReplyDeletehow to install sage 50 2018

sage 50 2017 download

download sage 50 2016 edition

sage 50 2015 download

download sage 50 2014 us edition

how to fix sage 50 error printer not activated error code 30

When you the first time user installing and updating on quickbooks desktop mostly user facing this error. This article guide to fix QuickBooks Desktop 1603 step by step.

ReplyDeletefix sage error server busy

ReplyDeletefix sage payroll error 2003

resolve error 1935 installing sage 50

how many sage 50 licenses should -purchase

sage error connecting database

fix sage act error 2601